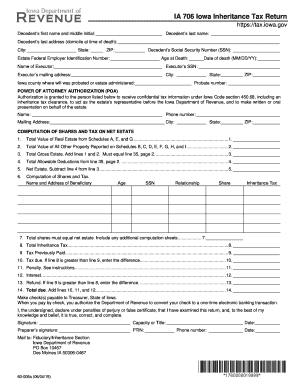

iowa inheritance tax form

Iowa Estate Tax Versus Iowa Inheritance Tax. Report Fraud.

:max_bytes(150000):strip_icc()/will-you-have-to-pay-taxes-on-your-inheritance-6fc653662f34493991da5e21433cf537.png)

3 Taxes That Can Affect Your Inheritance

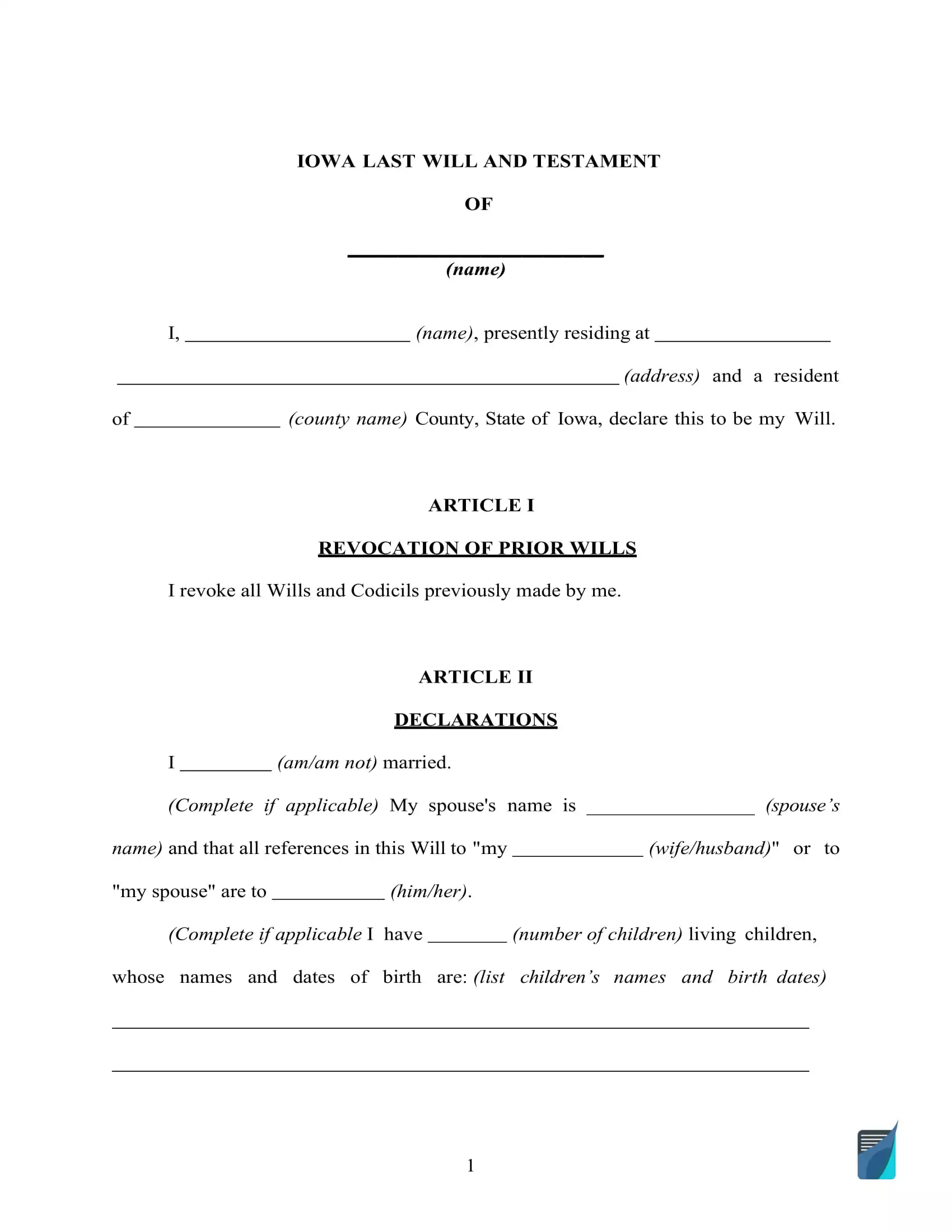

US Legal Forms lets you rapidly generate legally binding documents based on pre-built web-based templates.

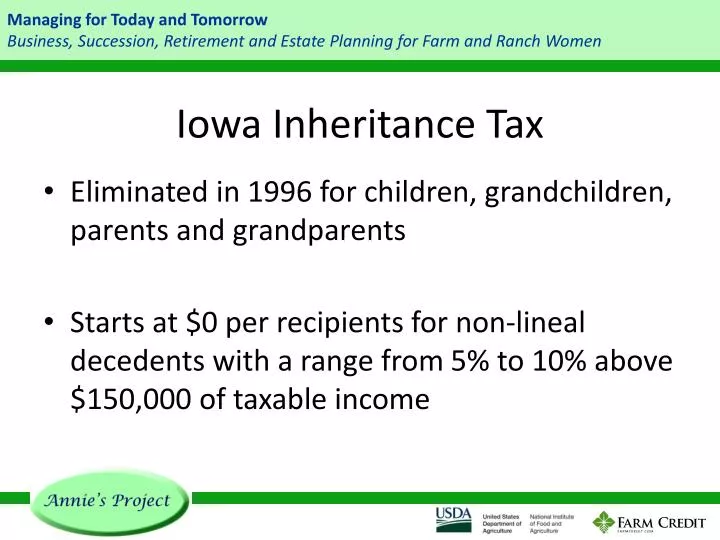

. The federal gift tax has a 15000 per year exemption for each gift recipient in. See the Iowa Inheritance Tax Rate Schedule Form 60-061 090611. Track or File Rent Reimbursement.

Report Fraud. Iowa inheritance tax is a tax paid to the State of Iowa and is based upon a persons. This is something you need to take into consideration before preparing Iowa Last Will and Testament to avoid any legal fees and penalties from the IRS in the future.

Adopted and Filed Rules. This is a tax on the right to receive money or property owned by the decedent at the time of death. Adopted and Filed Rules.

Inheritance Tax Checklist 60-007. Report Fraud. Not every Iowan who passes away will render their heirs subject to more.

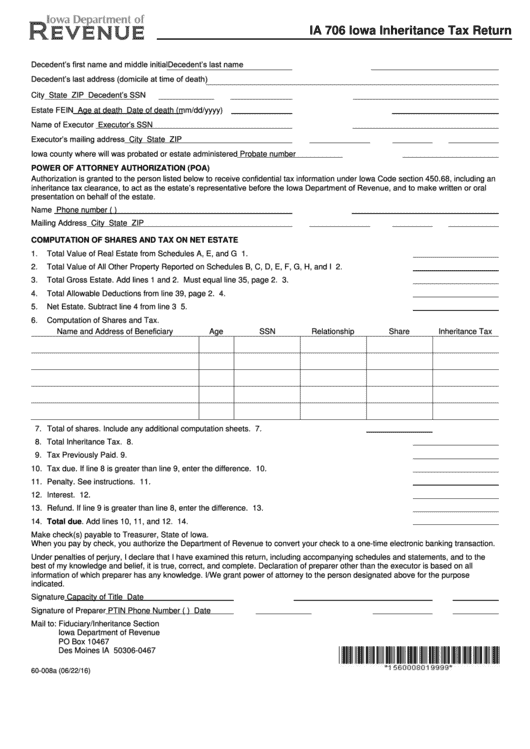

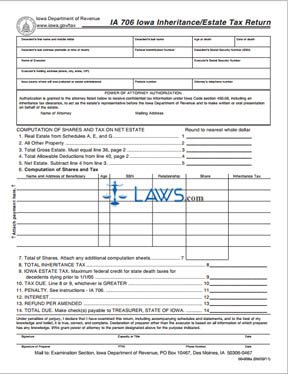

Register for a Permit. 68 including an inheritance tax clearance to act as the estate s representative before the Iowa Department of Revenue and to make written or oral presentation on behalf of the estate. If the return fails to.

This document is found on the website of the government of Iowa. Iowa InheritanceEstate Tax Return IA 706 Step 1. The good news in light of all this tax talk is that Iowas inheritance tax only applies in certain situations.

The personal representative is required to designate on the return who is to receive the clearance. Change or Cancel a Permit. Inheritance Tax Checklist 60-007.

An estate tax is levied against the entirety of an estate including any property monetary assets business assets etc owned by the decedent. Inheritance Tax Application for. Iowa is one of several states that have an inheritance tax.

Execute your docs within a few minutes using our straightforward step-by-step. This is something you need to take into consideration before preparing Iowa Last Will and Testament to avoid any legal fees and penalties from the IRS in the future. Therefore the signNow web application is a must-have for completing and signing 706 Iowa inheritance estate tax return 2013 form on the go.

Iowa is planning to completely repeal the inheritance tax by 2025. 4 out of 5. Adopted and Filed Rules.

Read more about Probate Form for use by Iowa probate attorneys only Print. It is different from the. To pay inheritance and estate tax in the state of Iowa file a form IA 706.

Get the up-to-date IA 706 Iowa InheritanceEstate Tax Return 2022 now Get Form. Iowa does not have a gift tax. In a matter of seconds receive an electronic.

What is Iowa inheritance tax. Inheritance tax clearance will be issued by the Department.

How To Pay Inheritance Tax With Pictures Wikihow Life

Iowa Inheritance Tax Law Explained

Iowa Inheritance Tax Rate Schedule Fill Out Sign Online Dochub

Estate Tax Vs Inheritance Tax Are They The Same

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com

How Much Is Inheritance Tax Community Tax

What Are Inheritance Taxes Turbotax Tax Tips Videos

Free Iowa Small Estate Affidavit Form Affidavit For Distribution Of Property Pdf Eforms

Free Form Ia 706 Iowa Inheritance Estate Tax Return Free Legal Forms Laws Com

Gift Tax Does This Exist At The State Level In New York

Inheritance Tax The Executor S Glossary By Atticus

Ppt Iowa Inheritance Tax Powerpoint Presentation Free Download Id 2926639

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com

Estate Inheritance Tax Threshold Rates Calculating How Much You Owe

Tax Talk Iowa S Inheritance Tax Gordon Fischer Law Firm

Iowa 706 Form Fill Out And Sign Printable Pdf Template Signnow

Iowa 706 Schedule J Fill Online Printable Fillable Blank Pdffiller